The Clothing and Accessories at New Fashion Stores, Inc. Are an Example of ________ Assets.

Introduction to Fiscal Statements

nine Ascertain, Explain, and Provide Examples of Electric current and Noncurrent Avails, Current and Noncurrent Liabilities, Equity, Revenues, and Expenses

In addition to what you've already learned nigh assets and liabilities, and their potential categories, there are a couple of other points to understand near assets. Plus, given the importance of these concepts, it helps to take an boosted review of the cloth.

To assist clarify these points, we return to our coffee shop case and now think of the coffee store's assets—items the java shop owns or controls. Review the listing of avails you created for the local coffee shop. Did you happen to notice many of the items on your list have one thing in mutual: the items volition exist used over a long period of time? In bookkeeping, we classify assets based on whether or not the asset will exist used or consumed within a certain period of fourth dimension, more often than not 1 yr. If the asset will exist used or consumed in one year or less, we classify the asset as a electric current asset. If the asset will exist used or consumed over more than than one year, we classify the asset every bit a noncurrent nugget.

Another affair you might accept recognized when reviewing your list of java shop assets is that all of the items were something you could bear upon or move, each of which is known as a tangible asset. However, as you as well learned in Describe the Income Statement, Argument of Owner'southward Equity, Residuum Sheet, and Statement of Cash Flows, and How They Interrelate, non all assets are tangible. An nugget could be an intangible nugget, significant the item lacks physical substance—it cannot be touched or moved. Take a moment to remember about your favorite type of shoe or a popular type of subcontract tractor. Would you exist able to recognize the maker of that shoe or the tractor by simply seeing the logo? Chances are you would. These are examples of intangible assets, trademarks to be precise. A trademark has value to the system that created (or purchased) the trademark, and the trademark is something the organisation controls—others cannot use the trademark without permission.

Like to the accounting for assets, liabilities are classified based on the time frame in which the liabilities are expected to be settled. A liability that volition be settled in one year or less (generally) is classified every bit a current liability, while a liability that is expected to be settled in more than one yr is classified every bit a noncurrent liability.

Examples of electric current assets include accounts receivable, which is the outstanding customer debt on a credit sale; inventory, which is the value of products to be sold or items to be converted into sellable products; and sometimes a notes receivable, which is the value of amounts loaned that will be received in the future with interest, assuming that it will be paid within a yr.

Examples of current liabilities include accounts payable, which is the value of appurtenances or services purchased that will be paid for at a afterwards date, and notes payable, which is the value of amounts borrowed (usually not inventory purchases) that will be paid in the hereafter with involvement.

Examples of noncurrent avails include notes receivable (notice notes receivable can be either current or noncurrent), state, buildings, equipment, and vehicles. An example of a noncurrent liability is notes payable (notice notes payable tin can be either current or noncurrent).

Why Does Electric current versus Noncurrent Affair?

At this point, permit's take a break and explore why the distinction between electric current and noncurrent assets and liabilities matters. It is a good question considering, on the surface, it does not seem to be important to make such a distinction. Afterwards all, avails are things owned or controlled past the organization, and liabilities are amounts owed by the arrangement; list those amounts in the fiscal statements provides valuable information to stakeholders. Just nosotros have to dig a picayune deeper and remind ourselves that stakeholders are using this data to make decisions. Providing the amounts of the avails and liabilities answers the "what" question for stakeholders (that is, it tells stakeholders the value of assets), but information technology does not answer the "when" question for stakeholders. For instance, knowing that an organization has ?1,000,000 worth of avails is valuable information, but knowing that ?250,000 of those avails are current and volition exist used or consumed inside i year is more valuable to stakeholders. Likewise, it is helpful to know the company owes ?750,000 worth of liabilities, but knowing that ?125,000 of those liabilities will be paid within one year is even more valuable. In brusk, the timing of events is of item interest to stakeholders.

Borrowing

When money is borrowed by an private or family from a bank or other lending institution, the loan is considered a personal or consumer loan. Typically, payments on these types of loans begin shortly later the funds are borrowed. Educatee loans are a special type of consumer borrowing that has a different structure for repayment of the debt. If y'all are not familiar with the special repayment arrangement for student loans, do a brief internet search to find out when pupil loan payments are expected to brainstorm.

At present, assume a college student has two loans—one for a car and one for a student loan. Assume the person gets the flu, misses a week of work at his campus job, and does not go paid for the absenteeism. Which loan would the person exist nigh concerned about paying? Why?

Equity and Legal Structure

Recall that equity can also be referred to every bit net worth—the value of the organization. The concept of equity does not change depending on the legal structure of the business (sole proprietorship, partnership, and corporation). The terminology does, nevertheless, alter slightly based on the type of entity. For example, investments by owners are considered "uppercase" transactions for sole proprietorships and partnerships but are considered "common stock" transactions for corporations. Also, distributions to owners are considered "cartoon" transactions for sole proprietorships and partnerships but are considered "dividend" transactions for corporations.

Every bit another example, in sole proprietorships and partnerships, the final amount of net income or net loss for the business becomes "Owner(southward), Capital." In a corporation, net income or cyberspace loss for the business becomes retained earnings, which is the cumulative, undistributed internet income or internet loss, less dividends paid for the business organisation since its inception.

The essence of these transactions remains the aforementioned: organizations become more than valuable when owners make investments in the concern and the businesses earn a profit (net income), and organizations become less valuable when owners receive distributions (dividends) from the organisation and the businesses incur a loss (net loss). Considering accountants are providing information to stakeholders, it is important for accountants to fully understand the specific terminology associated with the various legal structures of organizations.

The Accounting Equation

Call up the uncomplicated example of a home loan discussed in Draw the Income Argument, Statement of Owner'due south Disinterestedness, Balance Sheet, and Statement of Cash Flows, and How They Interrelate. In that case, we causeless a family unit purchased a home valued at ?200,000 and made a down payment of ?25,000 while financing the remaining balance with a ?175,000 banking concern loan. This case demonstrates one of the most important concepts in the study of accounting: the accounting equation, which is:

In our example, the accounting equation would await similar this:

\(?200,000=?175,000+?25,000\)

As you continue your accounting studies and you consider the unlike major types of business organisation entities available (sole proprietorships, partnerships, and corporations), there is another important concept for y'all to retrieve. This concept is that no thing which of the entity options that yous cull, the accounting process for all of them will be predicated on the bookkeeping equation.

It may be helpful to remember of the accounting equation from a "sources and claims" perspective. Nether this approach, the avails (items owned by the organization) were obtained by incurring liabilities or were provided by owners. Stated differently, every asset has a claim against it—by creditors and/or owners.

The Bookkeeping Equation

On a sheet of newspaper, employ three columns to create your own accounting equation. In the offset column, listing all of the things you ain (assets). In the second cavalcade, list whatsoever amounts owed (liabilities). In the 3rd column, using the accounting equation, summate, you guessed it, the net corporeality of the asset (equity). When finished, total the columns to determine your cyberspace worth. Hint: do not forget to subtract the liability from the value of the asset.

Here is something else to consider: is it possible to have negative equity? It sure is . . . enquire any college student who has taken out loans. At kickoff glance there is no asset straight associated with the amount of the loan. But is that, in fact, the case? Yous might ask yourself why make an investment in a college education—what is the benefit (asset) to going to college? The respond lies in the divergence in lifetime earnings with a college degree versus without a higher degree. This is influenced by many things, including the supply and demand of jobs and employees. It is also influenced by the earnings for the type of college degree pursued. (Where do you think bookkeeping ranks?)

Solution

Answers will vary but may include vehicles, wear, electronics (include cell phones and computer/gaming systems, and sports equipment). They may too include money owed on these assets, about probable vehicles and perchance cell phones. In the case of a student loan, at that place may be a liability with no corresponding asset (yet). Responses should be able to evaluate the benefit of investing in college is the wage differential betwixt earnings with and without a higher degree.

Expanding the Accounting Equation

Let'southward go on our exploration of the accounting equation, focusing on the equity component, in detail. Recall that we defined equity every bit the internet worth of an organization. It is helpful to also think of net worth as the value of the organization. Remember, too, that revenues (inflows as a result of providing appurtenances and services) increase the value of the organization. So, every dollar of revenue an system generates increases the overall value of the system.

Too, expenses (outflows as a effect of generating revenue) decrease the value of the organization. So, each dollar of expenses an organization incurs decreases the overall value of the organisation. The same approach can be taken with the other elements of the financial statements:

- Gains increase the value (equity) of the organization.

- Losses decrease the value (disinterestedness) of the organization.

- Investments past owners increase the value (equity) of the arrangement.

- Distributions to owners decrease the value (equity) of the organization.

- Changes in assets and liabilities can either increment or decrease the value (disinterestedness) of the organisation depending on the net effect of the transaction.

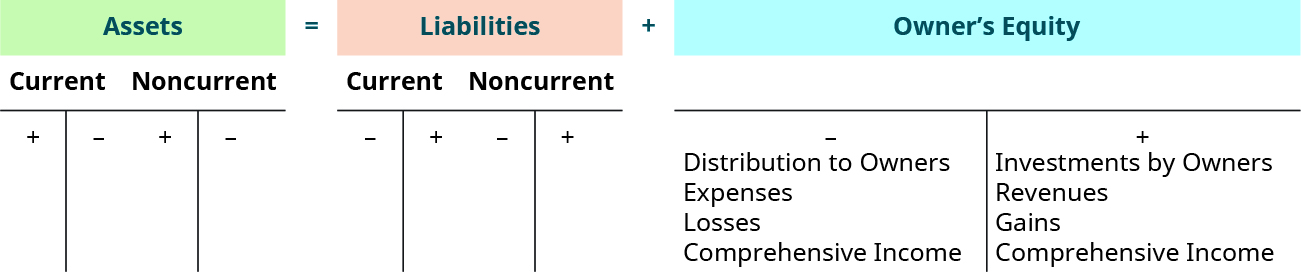

A graphical representation of this concept is shown in (Effigy).

Graphical Representation of the Accounting Equation. Both assets and liabilities are categorized as current and noncurrent. Also highlighted are the diverse activities that affect the disinterestedness (or net worth) of the business concern. (attribution: Copyright Rice University, OpenStax, nether CC Past-NC-SA 4.0 license)

The format of this illustration is as well intended to introduce y'all to a concept you will larn more than virtually in your study of accounting. Notice each account subcategory (Current Avails and Noncurrent Assets, for case) has an "increase" side and a "subtract" side. These are called T-accounts and will exist used to analyze transactions, which is the beginning of the accounting process. Meet Analyzing and Recording Transactions for a more comprehensive discussion of analyzing transactions and T-Accounts.

Non All Transactions Bear on Disinterestedness

As you go along to develop your understanding of accounting, you volition encounter many types of transactions involving different elements of the financial statements. The previous examples highlighted elements that modify the equity of an organisation. Not all transactions, yet, ultimately touch on equity. For instance, the following practice not impact the equity or net worth of the organization:1

- Exchanges of assets for assets

- Exchanges of liabilities for liabilities

- Acquisitions of assets by incurring liabilities

- Settlements of liabilities by transferring assets

It is of import to understand the inseparable connection between the elements of the fiscal statements and the possible impact on organizational equity (value). We explore this connection in greater detail as we render to the financial statements.

Key Concepts and Summary

- Assets and liabilities are categorized into current and noncurrent, based on when the detail will be settled. Assets and liabilities that volition be settled in 1 year or less are classified equally current; otherwise, the items are classified equally noncurrent.

- Assets are also categorized based on whether or non the asset has physical substance. Assets with physical substance are considered tangible avails, while intangible assets lack physical substance.

- The stardom between electric current and noncurrent avails and liabilities is important because it helps financial argument users assess the timing of the transactions.

- 3 broad categories of legal business structures are sole proprietorship, partnership, and corporation, with each construction having advantages and disadvantages.

- The accounting equation is Avails = Liabilities + Owner's Disinterestedness. It is of import to the report of accounting because it shows what the arrangement owns and the sources of (or claims confronting) those resources.

- Owners' equity can also be thought of every bit the cyberspace worth or value of the business. There are many factors that influence equity, including internet income or net loss, investments by and distributions to owners, revenues, gains, losses, expenses, and comprehensive income.

Multiple Choice

(Figure)Which of the following statements is truthful?

- Tangible assets lack physical substance.

- Tangible assets will be consumed in a year or less.

- Tangible assets have physical substance.

- Tangible avails will be consumed in over a year.

(Figure)Owners have no personal liability under which legal business organisation structure?

- a corporation

- a partnership

- a sole proprietorship

- There is liability in every legal business concern structure.

A

(Figure)The accounting equation is expressed as ________.

- Assets + Liabilities = Owner'southward Equity

- Assets – Noncurrent Avails = Liabilities

- Avails = Liabilities + Investments by Owners

- Assets = Liabilities + Owner's Equity

(Effigy)Which of the post-obit decreases owner'southward disinterestedness?

- investments past owners

- losses

- gains

- short-term loans

B

(Figure)Exchanges of assets for assets have what event on equity?

- increment equity

- may take no impact on equity

- decrease equity

- There is no relationship betwixt assets and disinterestedness.

(Figure)All of the following increase owner'south equity except for which one?

- gains

- investments by owners

- revenues

- acquisitions of assets by incurring liabilities

D

Questions

(Figure)Explain the deviation between current and noncurrent assets and liabilities. Why is this distinction important to stakeholders?

(Figure)Identify/discuss one similarity and i difference between tangible and intangible assets.

Both tangible and intangible assets have value to the company and can exist bought, sold, or dumb; tangible assets accept physical substance, while intangible assets do not.

(Figure)Name the three types of legal concern structure. Describe 1 advantage and one disadvantage of each.

(Figure)What is the "bookkeeping equation"? Listing two examples of business transactions, and explain how the bookkeeping equation would be impacted past these transactions.

Avails = Liabilities + Owner's Equity. Answers will vary and should include a combination of revenues/gains (increases), expenses/losses (decreases), investments (increases), and distributions (decreases). Information technology is important to empathise the following transactions/exchanges will not change disinterestedness: an asset for an asset, liability for liability, asset acquisitions past incurring liabilities, and asset reductions to reduce liabilities.

Exercise Set A

(Effigy)For each of the post-obit items, place whether the detail is considered current or noncurrent, and explicate why.

| Item | Current or Noncurrent? |

|---|---|

| Cash | |

| Inventory | |

| Machines | |

| Trademarks | |

| Accounts Payable | |

| Wages Payable | |

| Owner, Capital | |

| Accounts Receivable | |

(Figure)For the items listed below, indicate how the detail affects equity (increase, subtract, or no affect.

| Item | Increment? Decrease? or No Impact? |

|---|---|

| Expenses | |

| Avails | |

| Gains | |

| Liabilities | |

| Dividends | |

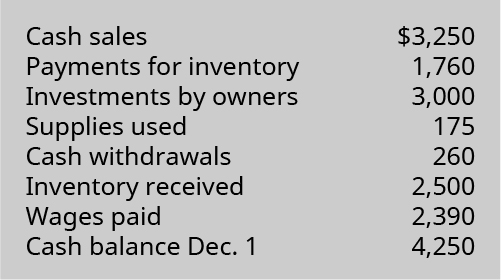

(Effigy)Forest Visitor had the following transactions during the month of December. What is the December 31 cash balance?

(Figure)Here are facts for the Hudson Roofing Company for December.

Assuming no investments or withdrawals, what is the ending balance in the owners' capital account?

Do Set B

(Figure)For each of the following items, place whether the item is considered electric current or noncurrent, and explicate why.

| Item | Current or Noncurrent? |

|---|---|

| Inventory | |

| Buildings | |

| Accounts Receivable | |

| Cash | |

| Trademarks | |

| Accounts Payable | |

| Wages Payable | |

| Mutual Stock | |

(Figure)For the items listed below, indicate how the particular affects equity (increase, decrease, or no bear upon).

| Item | Increase? Decrease? or No Impact? |

|---|---|

| Revenues | |

| Gains | |

| Losses | |

| Drawings | |

| Investments | |

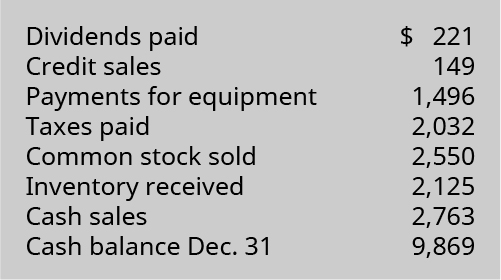

(Figure)Gumbo Company had the following transactions during the month of December. What was the December 1 greenbacks balance?

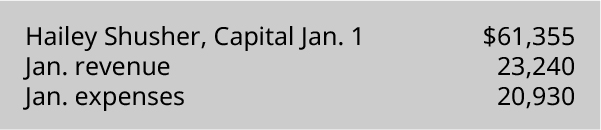

(Effigy)Here are facts for Hailey's Collision Service for January.

Bold no investments or withdrawals, what is the ending balance in the owners' capital account?

Problem Set A

(Effigy)For each of the post-obit independent transactions, bespeak whether in that location was an increase, a decrease, or no impact for each financial statement element.

| Transaction | Assets | Liabilities | Owners' Equity |

|---|---|---|---|

| Paid greenbacks for expenses | |||

| Sold mutual stock for cash | |||

| Owe vendor for purchase of asset | |||

| Paid owners for dividends | |||

| Paid vendor for amount previously owed | |||

(Figure)Olivia's Apple Orchard had the post-obit transactions during the month of September, the first month in business organisation.

Complete the chart to determine the ending balances. Equally an instance, the commencement transaction has been completed. Annotation: Negative amounts should be indicated with minus signs (–) and unaffected should be noted as ?0.

(Hints: ane. each transaction will involve two financial statement elements; 2. the net impact of the transaction may be ?0.)

(Figure)Using the information in (Figure), determine the corporeality of revenue and expenses for Olivia'southward Apple tree Orchard for the month of September.

Trouble Set B

(Figure)For each of the post-obit independent transactions, indicate whether at that place was an increase, decrease, or no affect on each financial statement element.

| Transaction | Avails | Liabilities | Owners' Equity |

|---|---|---|---|

| Received cash for sale of asset (no gain or loss) | |||

| Greenbacks distribution to owner | |||

| Cash sales | |||

| Investment past owners | |||

| Owe vendor for inventory purchase | |||

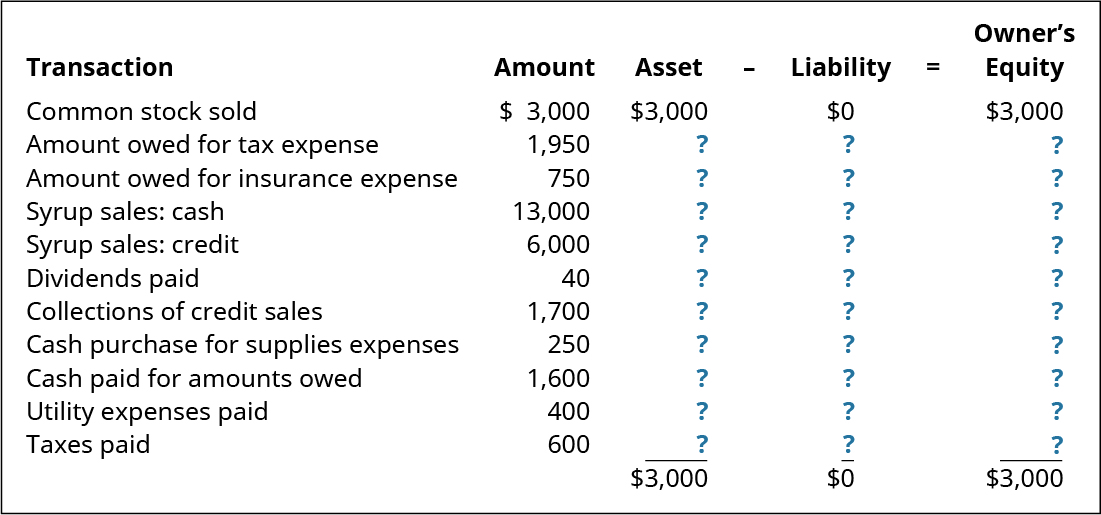

(Figure)Mateo's Maple Syrup had the post-obit transactions during the month of February, its first month in concern.

Consummate the chart to determine the ending balances. As an example, the starting time transaction has been completed. Notation: negative amounts should be indicated with minus signs (–).

(Hints: i. each transaction will involve two financial statement elements; two. the internet touch of the transaction may be ?0.)

(Effigy)Using the data in (Figure), determine the corporeality of revenue and expenses for Mateo'south Maple Syrup for the month of February.

Thought Provokers

(Effigy)A trademark is an intangible nugget that has value to a business. Assume that y'all are an auditor with the responsibility of valuing the trademark of a well-known company such as Nike or McDonald's. What makes each of these companies unique and adds value? While the value of a trademark may not necessarily be recorded on the visitor's balance canvass, discuss what factors you think would impact (increase or subtract) the value of the visitor'southward trademark? Consider your answer through the perspective of various stakeholders.

Footnotes

- 1SFAC No. 6, p. 20.

Glossary

- bookkeeping equation

- assets = liabilities + owner'south equity

- accounts payable

- value of goods or services purchased that will be paid for at a later date

- accounts receivable

- outstanding customer debt on a credit auction, typically receivable within a short time menstruation

- current asset

- asset that volition be used or consumed in 1 year or less

- current liability

- debt or obligation due within one year or, in rare cases, a company'south standard operating bike, whichever is greater

- inventory

- value of products to be sold or items to exist converted into sellable products

- noncurrent asset

- asset that will be used or consumed over more than one year

- noncurrent liability

- liability that is expected to exist settled in more than 1 year

- notes payable

- value of amounts borrowed that volition exist paid in the future with interest

- notes receivable

- value of amounts loaned that will be received in the future with involvement

- retained earnings

- cumulative, undistributed net income or net loss for the business organisation since its inception

0 Response to "The Clothing and Accessories at New Fashion Stores, Inc. Are an Example of ________ Assets."

Post a Comment